Time is money – how you spend both determines your financial future.

Money isn’t just about how much you earn — it’s about how you manage what you already have. The truth is, many people stay broke not because of low income, but because of repeated financial mistakes that quietly drain their wealth. The good news is that once you recognize them, you can start changing your money habits today.

One of the most common traps is living beyond your means. Credit cards, buy-now-pay-later schemes, and social pressure make it easy to spend more than you earn. It feels harmless in the moment, but debt always comes due, and interest keeps you stuck in the cycle. Closely linked to this is lifestyle inflation — every time your income rises, your spending rises with it. A new job or raise often leads to upgrading your car, moving to a bigger house, or dining out more often. Instead of saving the difference, you end up back at square one.

Another mistake is failing to prepare for the unexpected. Life happens: a medical bill, a car repair, or a sudden job loss. Without an emergency fund, even a small problem can turn into a financial disaster. Saving three to six months of expenses may sound overwhelming, but starting small builds security over time.

Too many people also avoid tracking their money. You might think you know where your salary goes, but unless you’re measuring it, you’re probably missing leaks. A streaming service you forgot about, coffee runs every day, or impulse shopping late at night — these little habits quietly add up. When you track your spending, you gain control.

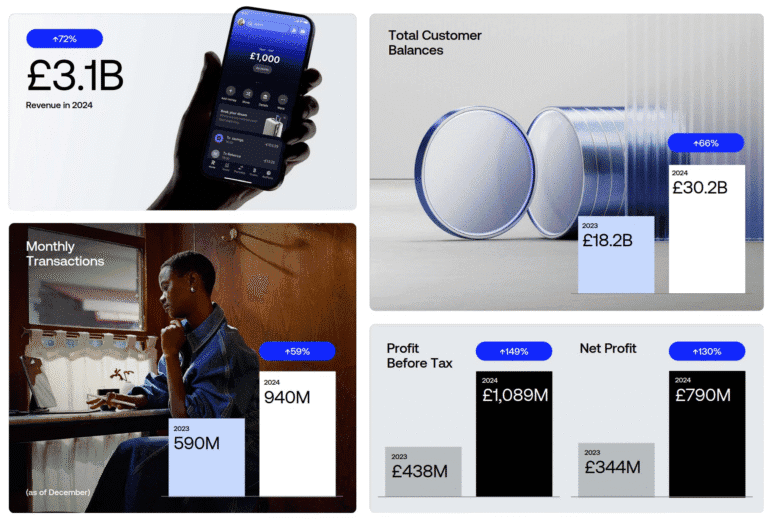

Keeping money idle is another silent mistake. Inflation erodes savings if they sit untouched in a checking account. While investing feels intimidating, safe options like index funds or retirement accounts grow your wealth steadily. By skipping investments, you lose the power of compounding — one of the most effective tools for building financial freedom.

Relying only on a single source of income also leaves you vulnerable. If one paycheck stops, your entire financial stability collapses. Even a small side hustle, part-time freelance work, or investing dividend income can make a big difference over time.

Finally, many people don’t set clear goals. Without direction, money slips away without purpose. Having specific targets — like paying off debt, saving for a house, or hitting a retirement number — acts as a roadmap that guides daily financial decisions. Those who plan ahead are far more likely to succeed.

The difference between financial stress and financial freedom rarely comes down to income alone. It’s about habits. By avoiding these mistakes — overspending, skipping savings, ignoring investments, or chasing lifestyle upgrades — you can take control of your money in 2025 and finally start building wealth that lasts.

1 thought on “Personal Finance Mistakes That Keep You Broke”

Comments are closed.