1. What Is an Investment Scam?

An investment scam is a fraudulent scheme where scammers promise high returns with little to no risk to lure people into parting with their money. These scams often involve fake businesses, bogus trading platforms, and misleading claims.

2. Common Signs of an Investment Scam

a) Unrealistic Promises of High Returns

If an opportunity guarantees “doubled profits in weeks”, that’s a major red flag. Legitimate investments involve risk.

b) Pressure to Act Immediately

Scammers create a sense of fake urgency, so you don’t have time to think or research. A genuine financial advisor will never rush you. As soon as I notice the sense of urgency in how you speak, I will give up on the whole charade. This is usually my first sign that it’s fake.

c) No Proper Documentation or Regulation

If a company is not licensed by a regulatory body such as the Financial Conduct Authority (FCA) or the SEC, it is best to avoid it immediately. You can easily verify the authenticity of a company by conducting a quick search on Google. In Nigeria, we also have a platform called “Nairaland,” which can be useful for this purpose. Simply search for the name of the company, and you will find previous comments from users. If the company is a scam, the feedback will likely indicate that.

d) Unverifiable Testimonials

Most scam websites use fake success stories with stock images and fabricated claims. Always double-check reviews on trusted sources. If the testimonies sound flat/scripted, with no emotions, or exaggerated, then it’s probably fake. E.g., “Oh my gosh, this is the best thing that’s ever happened to me!!!” (but their face stays blank, voice feels forced, and timing is unnatural)

3. How to Avoid Falling for an Investment Scam

a) Verify the Company’s Legitimacy

Search for the company’s registration details on official financial regulators’ websites.

b) Do Your Research

Check trusted platforms like:

c) Avoid Sharing Personal Details

Never share your bank details, passwords, or ID information with unverified platforms.

d) Ask Questions Before Investing

If the person pitching can’t explain how the investment works, it’s likely a scam.

4. Real-Life Examples of Investment Scams

- Ponzi Schemes → Promise profits from other investors’ money.

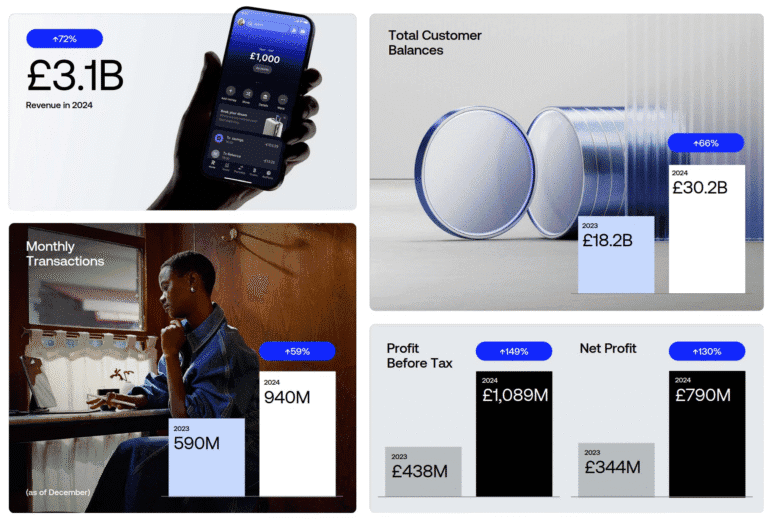

- Crypto Investment Frauds → Fake coins, wallets, and trading apps.

- Fake Forex Platforms → Manipulate dashboards to show fake profits.

In 2024 alone, global investors lost over $5 billion to fraudulent schemes, according to Statista.

5. What to Do If You Suspect an Investment Scam

- Report immediately to your local financial regulator.

- Contact your bank to freeze suspicious transactions.

- File a complaint on Fraud.org.

6. Key Takeaways to Stay Safe

- If it sounds too good to be true, it probably is.

- Always research before investing.

- Only use regulated investment platforms.

Stay Alert to Avoid an Investment Scam

Falling victim to an investment scam can have devastating financial and emotional consequences, but the good news is that you can protect yourself. By learning to spot the warning signs, researching every opportunity thoroughly, and using trusted financial sources, you strengthen your defense against scammers.

Always remember:

- If an offer sounds too good to be true, it probably is.

- Never rush into investments without verifying the company or broker.

- Use only regulated platforms and seek advice from financial experts when in doubt.

Your financial security depends on staying informed and cautious. Share this guide with friends and family to help them recognize the signs of an investment scam before it’s too late.

You can visit the Financial Industry Regulatory Authority (FINRA) BrokerCheck (https://brokercheck.finra.org/?utm_source=chatgpt.com) to confirm whether a financial advisor or brokerage firm is properly registered. This ensures you’re dealing with legitimate professionals and not falling for an investment scam.

Finally, for international checks, the International Organization of Securities Commissions (IOSCO) (https://www.iosco.org/?utm_source=chatgpt.com) provides a global database of regulated entities and investor protection alerts. This is especially helpful if you’re considering cross-border investment opportunities.