Saving money has never been easier! In today’s fast-paced digital world, technology gives you the tools to grow your money and manage your finances stress-free. With the best saving apps 2025, you can automate your savings, invest wisely, and stay on top of your financial goals.

Managing your finances can feel overwhelming, but technology has made saving and growing your money easier than ever. With the best saving apps 2025, you can track expenses, set financial goals, and automate your savings — no matter where you are in the world.

In this article, we’ll explore the 10 best saving apps worldwide in 2025 that help you manage your finances, invest smarter, and achieve financial freedom.

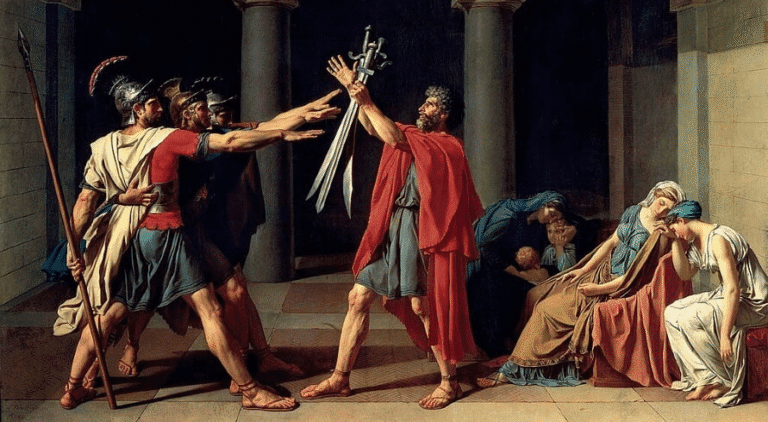

1. Revolut — Best for Global Money Management

Revolut is one of the most popular financial apps worldwide. Moreover, it offers multi-currency accounts, budget tracking, and automated savings. Also, you can even invest in stocks, crypto, and commodities, all in one place.

Key Features:

- Supports 30+ currencies

- Instant savings vaults

- Real-time spending insights

Best For: Frequent travelers and digital nomads.

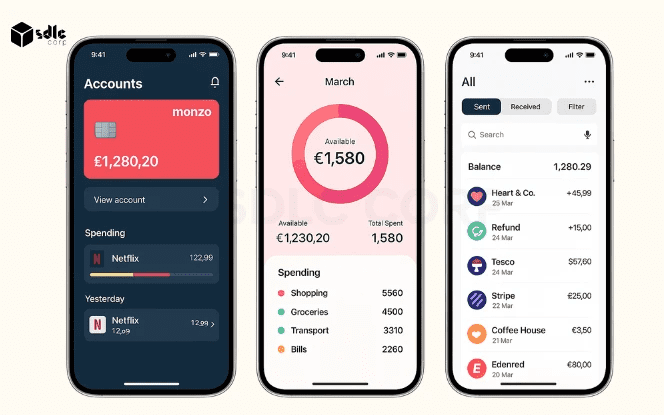

2. Monzo — Best Saving App for Budgeting & Smart Saving

Monzo is a UK-based digital bank loved for its intuitive budgeting features and automated saving pots. In addition, it gives instant spending notifications and allows you to round up transactions to save effortlessly.

Key Features:

- Automatic savings pots

- Fee-free international payments

- Spending analytics

Best For: Users who want an all-in-one banking and savings experience.

3. Chime — For Fee-Free Banking

Chime, a US-based saving and banking app, helps users save automatically without monthly fees. Additionally, it offers early paycheck access and high-yield savings accounts for better returns.

Key Features:

- No hidden banking fees

- High-yield savings account (HYSA)

- Round-up automatic savings

Best For: Anyone seeking simple, automated savings with zero costs.

4. N26 — Best Saving App 2025 for European Users

N26 is a Germany-based digital banking app that makes saving and budgeting seamless. Meanwhile, it offers Spaces, a feature that lets you create separate sub-accounts to manage financial goals effectively.

Key Features:

- Spaces for organized savings

- Fee-free international transactions

- Real-time spending insights

Best For: European residents looking for a modern, mobile-first savings experience.

5. Acorns — Best Saving App 2025 for Beginners

Acorns is a US-based micro-investing app perfect for beginners. Thus, it automatically rounds up your purchases and invests the spare change in diversified portfolios. As a result, your savings grow passively while you spend as usual.

Key Features:

- Automated micro-investing

- Round-up saving feature

- Educational resources for beginners

Best For: People new to saving and investing.

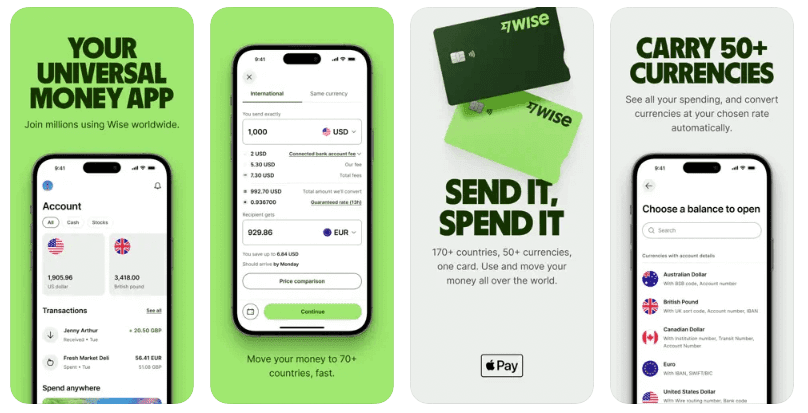

6. Wise — Best Saving App 2025 for Multi-Currency Savings

Formerly known as TransferWise, Wise is ideal for users who save and spend across multiple currencies. Moreover, it offers borderless accounts, therefore making it perfect for travelers and freelancers.

Key Features:

- Save in over 50 currencies

- Low international transfer fees

- Virtual and physical cards

Best For: Freelancers, remote workers, and international businesses.

7. YNAB (You Need A Budget) — Best Saving App 2025 for Financial Planning

YNAB focuses on helping users budget every dollar. Consequently, it’s a savings app that teaches financial discipline, ensuring every cent is tracked and allocated wisely.

Key Features:

- Zero-based budgeting system

- Debt payoff planning

- Real-time progress tracking

This is best for People who want full control over their finances.

8. Mint — Best Saving App 2025 for Personal Finance Tracking

Mint is one of the oldest and most trusted money management apps. Meanwhile, it links to your bank accounts, automatically categorizes transactions, and provides personalized saving insights.

Key Features:

- Automatic expense tracking

- Credit score monitoring

- Budgeting and saving insights

Best For: Individuals seeking a complete financial overview in one place.

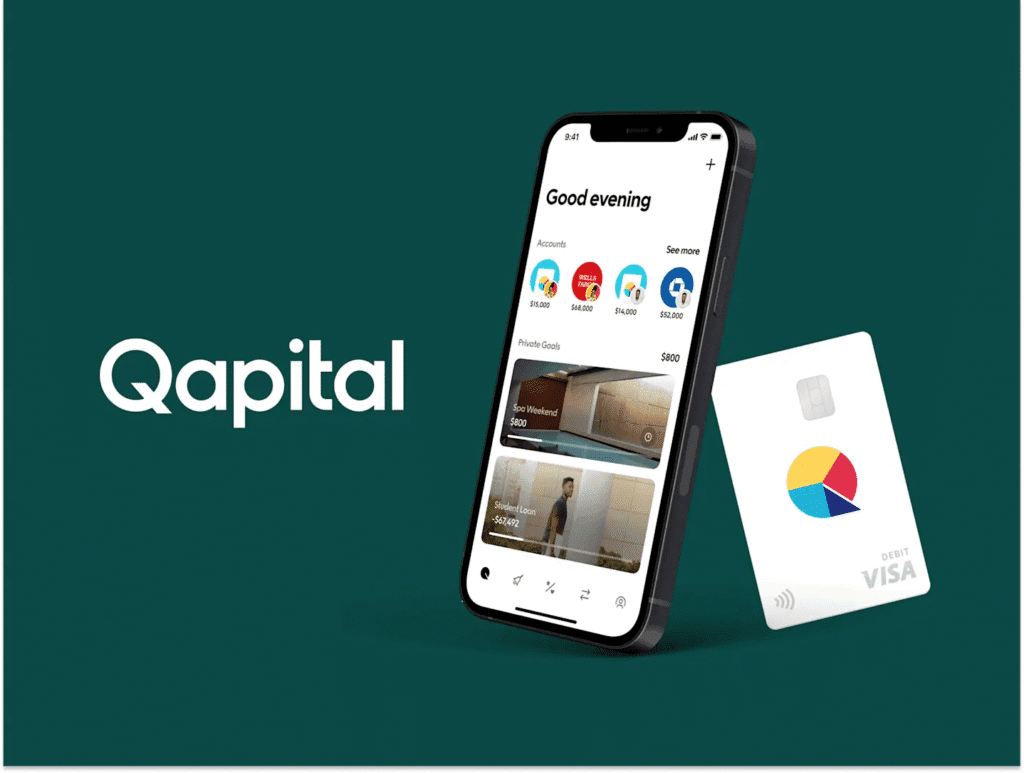

9. Qapital — Best Saving App 2025 for Goal-Based Savings

Qapital uses behavioral psychology to help users save money effortlessly. In fact, you can set personalized saving rules, such as saving $5 whenever you skip a coffee run.

Key Features:

- Custom saving rules

- Group saving goals

- Integrated investment options

Best For: People who need motivation to save consistently.

10. Stash — Best Saving App 2025 for Beginner Investors

Stash combines saving and investing into one user-friendly platform. Furthermore, it allows you to start with as little as $5, making it ideal for beginners who want to build wealth slowly.

Key Features:

- Fractional investing

- Automated savings

- Curated investment recommendations

Best For: Users who want to save and invest simultaneously.

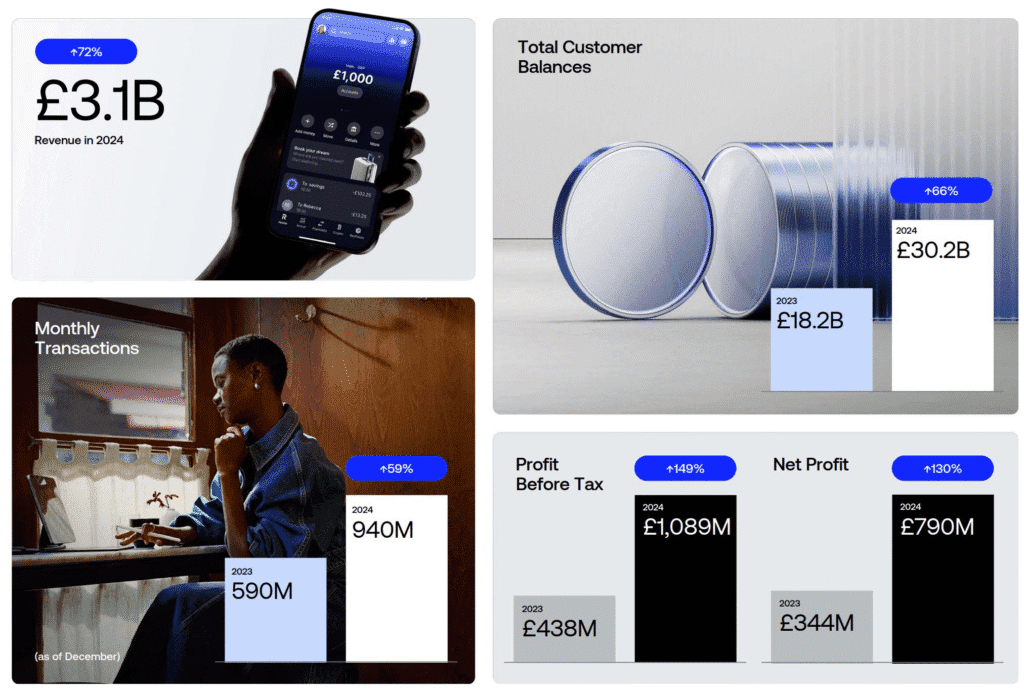

A summary: Best Saving Apps 2025

| App Name | Best For | Key Benefit |

|---|---|---|

| Revolut | Global finance | Multi-currency savings & investing |

| Monzo | Budgeting | Smart saving pots & instant spending insights |

| Chime | Zero fees | High-yield accounts & automatic round-ups |

| N26 | European users | Spaces for organized savings |

| Acorns | Beginners | Automated micro-investing |

| Wise | Multi-currency | Low-cost international savings |

| YNAB | Budgeting discipline | Zero-based budgeting approach |

| Mint | Financial overview | Credit tracking & automated budgeting |

| Qapital | Goal-based savers | Custom saving rules |

| Stash | New investors | Save & invest in one place |

Final Thoughts on these Saving Apps

The best saving apps 2025 make managing your money easier, faster, and smarter. Whether you want to automate savings, track spending, or invest globally, apps like Revolut, Chime, Monzo, Wise, and Acorns offer powerful tools to help you achieve financial freedom.

Start today. With the right app, your financial goals are just a few clicks away.

For a broader overview of top-rated savings tools, you can also explore Forbes Advisor’s expert review of the best saving apps, which highlights global options and in-depth comparisons.